What to Do Before the Next Crash

Executive Summary

* Are you prepared for a 'bank holiday'? (Hint: It's not nearly as fun as it sounds)

* Smart wealth safety strategies

* Securing the "big four" essentials: shelter, food, fuel, and water

* The immense advantage of cultivating a healthy mindset

* Why the steps before a crisis are so much more valuable than those taken afterwards

READ MORE: http://www.chrismartenson.com/martensonreport/what-do-before-next-crash

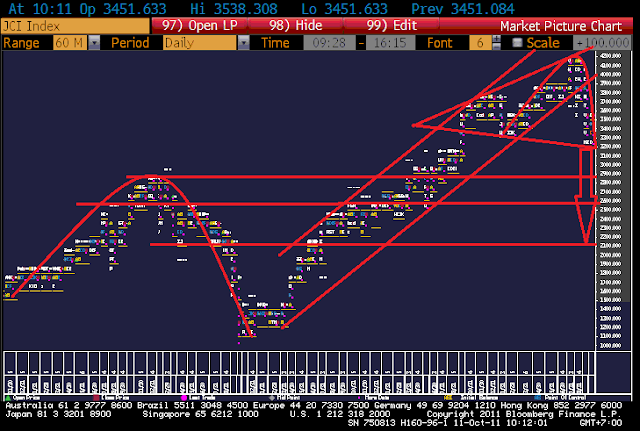

Global Moving Averages Show Market Recovery In Sight

As shown in the tables below, the key conclusions are as follows:

* Most developed markets are again trading above their 50-day moving averages (indicating the secondary trend), including the MSCI World Index and all the major U.S. indices. It is not surprising to see markets such as Greece and Portugal bucking the trend, with Japan also an underperformer.

* Considering the 200-day moving averages (an indicator of the primary trend), all the developed markets with the exception of New Zealand are below their averages, with Austria, Greece and Singapore more than two standard deviations in the red.

READ MORE: http://www.econmatters.com/2011/10/global-moving-averages-show-market.html

The Great Crash and Beyond

Gaithersburg, Maryland – The worst quarter for stocks since the first quarter of 2009 sent me back to the dusty archives of finance. Amid old tomes, I searched for what I might learn from the dark markets of years past. I found a collection of articles called The Great Crash and Beyond. They date from 1979, put together on the 50th anniversary of the crash of 1929. Only a handful of years before, the market fell by half (1973-74). Inside, I find writers reflecting on the mosaic of Wall Street history and the continuity of markets across the time.

READ MORE: http://dailyreckoning.com/the-great-crash-and-beyond/#ixzz1ap61Vh6V

Martin Armstrong - Lessons from ’87 Crash & What’s Coming

With continued turmoil in global markets, King World News interviewed internationally followed Martin Armstrong, Founder and Former Head of Princeton Economics International, Ltd.. Armstrong’s firm rose to be perhaps the largest multinational corporate advisor in the world. When asked what to look for going forward, Armstrong told KWN a fascinating account of what led to the ’87 Crash, “When Volcker raised interest rates to crazy levels, the discount rate up to 17% going into 1981, a tremendous amount of capital starts coming from overseas into the United States. So that drives the dollar up going into 1985 to a point where the (British) pound had fallen from 2.40 to par vs the dollar.”

READ MORE: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/10/14_Martin_Armstrong_-_Lessons_from_87_Crash_%26_Whats_Coming.html

Foreigners Dump $74 Billion In Treasurys In 6 Consecutive Weeks:

Biggest Sequential Outflow In History

Over the weekend, we observed the perplexing sell off of $56 billion in US Treasurys courtesy of weekly disclosure in the Fed's custodial account (source: H.4.1) and speculated if this may be due to an asset rotation, under duress or otherwise, out of bonds and into stocks, to prevent the collapse of the global ponzi (because when the BRICs tell the IMF to boost its bailout capacity you know it is global).

READ MORE: http://www.zerohedge.com/news/foreigners-dump-74-billion-treasurys-6-consecutive-weeks-biggest-sequential-outflow-history

Blog milik Andri Zakarias Siregar, Analis, Trader, Investor & Trainer (Fundamental/Technical/Flowtist/Bandarmologi: Saham/FX/Commodity), berpengalaman 14 tahun. Narasumber: Berita 1 First Media, Channel 95 MNC(Indovision), MetroTV, ANTV, Bloomberg BusinessWeek, Investor Today, Tempo, Trust, Media Indonesia, Bisnis Indonesia, Seputar Indonesia, Kontan, Harian Jakarta, PasFM, Inilah.com, AATI-IFTA *** Semoga analisa CTA & informasi bermanfaat. Happy Zhuan & Success Trading. Good Luck.

Saturday, October 15, 2011

Europe's Crunch Time May Drive Market Amid Earnings Flood

http://www.cnbc.com/id/44910718

Stocks Log 10-Week High; Dow, Nasdaq Up for 2011

http://www.cnbc.com/id/44902461

Coming Up Next Week:

MONDAY: Empire state mfg survey, industrial production, Fed's Lacker and Evans speak; Earnings from Citigroup, Wells Fargo, Halliburton, Hasbro and IBM

TUESDAY: PPI, treasury international capital, housing market index, Bernanke speaks; Earnings from BofA, Coca-Cola, Goldman Sachs, J&J, Apple, Intel, CSX and Yahoo

WEDNESDAY: Weekly mortgage apps, CPI, housing starts, Fed's Rosengren speaks, oil inventories, Fed's Beige Book; Earnings from Morgan Stanley, Travelers, United Tech, AmEx, Ebay, Western Digital

THURSDAY: Jobless claims, existing home sales, Philadelphia Fed survey, leading indicators, Fed's Bullard and Kocherlakota speak, NewsCorp investor day; Earnings from AT&T, Eli Lilly, Nokia, AutoNation, Microsoft, Capital One, Chipotle and SanDisk

FRIDAY: Fed's Kocherlakota speaks, 2011 Dodd-Frank Rulemaking Deadline; Earnings from GE, McDonald's, Verizon, Honeywell and Schlumberger

Fourteen of 28 people surveyed expect corn to rise next week and 19 of 27 anticipate the same thing for soybeans.

Gold survey results: Bullish: 22 Bearish: 1 Hold: 2

Copper survey results: Bullish: 7 Bearish: 1 Hold: 1

Corn survey results: Bullish: 14 Bearish: 9 Hold: 5

Soybean survey results: Bullish: 19 Bearish: 5 Hold: 3

Raw sugar survey results: Bullish: 7 Bearish: 4 Hold: 1

White sugar survey results: Bullish: 8 Bearish: 3 Hold: 1

White sugar premium results: Widen: 6 Narrow: 2 Neutral: 4

http://www.cnbc.com/id/44910718

Stocks Log 10-Week High; Dow, Nasdaq Up for 2011

http://www.cnbc.com/id/44902461

Coming Up Next Week:

MONDAY: Empire state mfg survey, industrial production, Fed's Lacker and Evans speak; Earnings from Citigroup, Wells Fargo, Halliburton, Hasbro and IBM

TUESDAY: PPI, treasury international capital, housing market index, Bernanke speaks; Earnings from BofA, Coca-Cola, Goldman Sachs, J&J, Apple, Intel, CSX and Yahoo

WEDNESDAY: Weekly mortgage apps, CPI, housing starts, Fed's Rosengren speaks, oil inventories, Fed's Beige Book; Earnings from Morgan Stanley, Travelers, United Tech, AmEx, Ebay, Western Digital

THURSDAY: Jobless claims, existing home sales, Philadelphia Fed survey, leading indicators, Fed's Bullard and Kocherlakota speak, NewsCorp investor day; Earnings from AT&T, Eli Lilly, Nokia, AutoNation, Microsoft, Capital One, Chipotle and SanDisk

FRIDAY: Fed's Kocherlakota speaks, 2011 Dodd-Frank Rulemaking Deadline; Earnings from GE, McDonald's, Verizon, Honeywell and Schlumberger

Fourteen of 28 people surveyed expect corn to rise next week and 19 of 27 anticipate the same thing for soybeans.

Gold survey results: Bullish: 22 Bearish: 1 Hold: 2

Copper survey results: Bullish: 7 Bearish: 1 Hold: 1

Corn survey results: Bullish: 14 Bearish: 9 Hold: 5

Soybean survey results: Bullish: 19 Bearish: 5 Hold: 3

Raw sugar survey results: Bullish: 7 Bearish: 4 Hold: 1

White sugar survey results: Bullish: 8 Bearish: 3 Hold: 1

White sugar premium results: Widen: 6 Narrow: 2 Neutral: 4

Friday, October 14, 2011

Laporan & Rumor Saham Indonesia 14-10 (Refresh)

Hmm.. Wall Street Terangkat Data Penjualan Ritel

http://pasarmodal.inilah.com/read/detail/1785415/hmm-wall-street-terangkat-data-penjualan-ritel

Aksi Jual Mendera, IHSG Melemah 0,2%. net foreign sell Rp169,1 miliar

http://pasarmodal.inilah.com/read/detail/1785320/aksi-jual-mendera-ihsg-melemah-02

Profit Taking Saham Unggulan Gerus IHSG 10 Poin

http://finance.detik.com/read/2011/10/14/160708/1744241/6/profit-taking-saham-unggulan-gerus-ihsg-10-poin

Inilah Daftar 'Net Foreign Buy' Jumat (14/10)

http://pasarmodal.inilah.com/read/detail/1785389/inilah-daftar-net-foreign-buy-jumat-1410

Inilah Daftar 'Net Foreign Sell' Jumat (14/10)

http://pasarmodal.inilah.com/read/detail/1785374/inilah-daftar-net-foreign-sell-jumat-1410

INCO Bagi Dividen Interim 2011 US$100 Juta

http://pasarmodal.inilah.com/read/detail/1785377/inco-bagi-dividen-interim-2011-us100-juta

ASGR Bagi Dividen Interim Rp12/Saham

http://pasarmodal.inilah.com/read/detail/1785373/asgr-bagi-dividen-interim-rp12saham

GMTD akan bayar dividen Rp 38 per saham

http://investasi.kontan.co.id/v2/read/1318574659/80024/GMTD-akan-bayar-dividen-Rp-38-per-saham-

Pasar Berspekulasi Soal Pertemuan G20

http://pasarmodal.inilah.com/read/detail/1785362/pasar-berspekulasi-soal-pertemuan-g20

Duh! 28 Emiten Telat Sampaikan LKTT

http://pasarmodal.inilah.com/read/detail/1785314/duh-28-emiten-telat-sampaikan-lktt

Syarat Kurang, Rights Issue MYOH Ditunda

http://finance.detik.com/read/2011/10/14/162523/1744265/6/syarat-kurang-rights-issue-myoh-ditunda

Induk TvOne Cs Dapat Izin Pra Efektif IPO

http://finance.detik.com/read/2011/10/14/144558/1744169/6/induk-tvone-cs-dapat-izin-pra-efektif-ipo

Antam Olah Emas dan Perak Tambang Martabe

http://finance.detik.com/read/2011/10/14/132000/1744062/6/antam-olah-emas-dan-perak-tambang-martabe

DJ Astra International Raised To Overweight vs Neutral By HSBC. Target Cut Tp Rp 75.000 vs Rp 76.000 By HSBC.

1st session JCI on 14.10.11

3661.18(-14.20pts)(-0.38%)

(H: 3688.14 ; L: 3658.93 )

Value: 2.94T (NG 1.69T )

Volume: 2.34 B (NG 839 M )

Foreign Nett Buy: 56 B

USD/IDR : 8865 (On Shore)

8865 (Off Shore)

6 MARKET DRIVEN BY SECTOR

MINING. (-0.70%)(1957.152 B )

FINANCE. (-0.06%)(373.175 B )

MANUFACTUR(-0.33%)(221.046 B )

INFRASTRUC. (-0.97%)(204.613 B )

PROPERTY(-0.57%)(73.882 B )

CONSUMER(-0.40%)(35.673 B )

6 NETT BUY STOCKs BY FOREIGN

BBRI. @6549. (103.78 B )

SMGR. @8843. (6.56 B )

UNTR. @23057(4.86 B )

BMRI. @6674. (3.99 B )

AALI. @18982 (3.56 B )

BDMN. @5125. (3.55 B )

6 NETT SELL STOCKs BY FOREIGN

TLKM. @7219. (33.16 B )

HRUM. @7589. (23.62 B )

PTBA. @16957. (21.63 B )

CMNP. @1503. (2.63 B )

BUMI. @2171. (2.59 B )

INCO. @3160. (2.34 B )

8 MOST ACTIVE STOCKs BY VALUE

BBRI. @6500. (+0.77%)

TLKM. @7200. (-0.69%)

BUMI. @2175. (0.00%)

ADRO. @1870. (+0.53%)

CMNP. @1500. (+2.74%)

TRAM. @790. (0.00%)

ENRG. @154. (+1.31%)

BMRI. @6600. (-0.75%)

8 MOST ACTIVE STOCKs BY VOLUME

ENRG. @154. (311.202 M )

ELTY. @116. (86.314 M )

BNBR. @52. (76.713 M )

DEWA. @80. (62.546 M )

TRAM. @790. (62.075 M )

APIC. @465. (55.072 M )

KIJA. @168. (52.460 M )

*DJ Bakrie & Brothers: Considering Repaying Or Restructuring $597 Mln Debt

JAKARTA (Dow Jones)--PT Bakrie & Brothers (BNBR.JK) is considering repaying or restructuring $597 million of debt arranged by Credit Suisse in the near future, the Indonesian holding company said Friday. The company, whose business interests include plantations, telecommunications, mining and property, said it is in "continuous discussions" with related parties on the debt.

GMTD akan bayar dividen Rp 38 per saham Batas akhir perdagangan saham dengan hak dividen atau cum dividen di pasar reguler dan pasar negosiasi hingga 2 November 2011. Sementara, cum dividen di pasar tunai sampai 7 November 2011.

Beli Asing Gagal Akhiri IHSG Sesi I di Zona Hijau. net foreign buy Rp55,54 miliar.

http://pasarmodal.inilah.com/read/detail/1785218/beli-asing-gagal-akhiri-ihsg-sesi-i-di-zona-hijau

Investor Tunggu Hasil G20, IHSG Menipis 14 Poin

http://finance.detik.com/read/2011/10/14/113617/1743982/6/investor-tunggu-hasil-g20-ihsg-menipis-14-poin

Sesi Dua, Pilih Saham 'Second Liner'

http://pasarmodal.inilah.com/read/detail/1785216/sesi-dua-pilih-saham-second-liner

Emisi Efek Baru Capai Rp 68,26 Triliun Hingga Oktober

http://finance.detik.com/read/2011/10/14/114211/1743991/6/emisi-efek-baru-capai-rp-6826-triliun-hingga-oktober

Agenda 14 Oktober CHANDRA ASRI PETROCHEMICAL (TPIA) DIVIDEND, RP 14,5 CUM, rupslb myoh 17 Oktober BANK MAYAPADA INTERNASIONAL RUPSLB, Masyarakat Energi Terbarukan Indonesia (METI) akan menyelenggarakan pertemuan para pakar dan praktisi energi terbarukan dan efisiensi energi tingkat dunia di Bali, 17-19 Oktober 2011, METRO REALTY STOCK SPLIT, RASIO 4:1

Bloomberg: Palm Oil Gains, Set for First Weekly Advance in Four on Demand

Bloomberg: Indofood CBP Sales May Rise on Thai Floods: Standard Chartered

Bloomberg: Indonesia Bonds Head for Weekly Gain on Inflows; Rupiah Steady

Bloomberg: Bank Negara Indonesia, NWS Added to Citi’s Top Quant Buy List

Bloomberg: Emerging Stock Fund Outflows Slow on Policy Steps, Citi Says

Bloomberg: Nusantara Joins 11.7 Trillion Rupiah Port Tender, Daily Reports

Bloomberg: Indonesia to Reintroduce Stock Options Next Year, Bourse Says

Sentimen Eropa Negatif, IHSG Dibuka Turun 0,12%

http://pasarmodal.inilah.com/read/detail/1785166/sentimen-eropa-negatif-ihsg-dibuka-turun-012

Inilah Saham-saham Berpeluang Profit Taking

http://pasarmodal.inilah.com/read/detail/1785159/inilah-saham-saham-berpeluang-profit-taking

Raup Pinjaman Glencore, 'Speculative Buy' BNBR

http://pasarmodal.inilah.com/read/detail/1785168/raup-pinjaman-glencore-speculative-buy-bnbr

Stagnasi Ekonomi Negara Besar Bertahan Hingga 2012

http://pasarmodal.inilah.com/read/detail/1785190/stagnasi-ekonomi-negara-besar-bertahan-hingga-2012

IHSG 4.000-4.100, Probabilitas 70 Persen

http://pasarmodal.inilah.com/read/detail/1784988/ihsg-4000-4100-probabilitas-70-persen

Kabar Negatif dari Spanyol, IHSG Bisa Terkoreksi Lagi

http://finance.detik.com/read/2011/10/14/072613/1743792/6/kabar-negatif-dari-spanyol-ihsg-bisa-terkoreksi-lagi

Alfamart Private Placement Minimal Rp 3.386 per Saham

http://finance.detik.com/read/2011/10/14/101248/1743903/6/alfamart-private-placement-minimal-rp-3386-per-saham

Lippo Karawaci Siapkan Rp 600 Miliar untuk Buyback Saham

http://finance.detik.com/read/2011/10/14/104713/1743921/6/lippo-karawaci-siapkan-rp-600-miliar-untuk-buyback-saham

Rumor suplai suku cadang terganggu menyebabkan saham ASII turun

http://investasi.kontan.co.id/v2/read/1318564240/80001/Rumor-suplai-suku-cadang-terganggu-menyebabkan-saham-ASII-turun

Saham INDF tersokong sentimen banjir Thailand

http://investasi.kontan.co.id/v2/read/1318564727/80003/Saham-INDF-tersokong-sentimen-banjir-Thailand

Ijin Penjamin Emisi Waterfront Securities Keluar

http://pasarmodal.inilah.com/read/detail/1785197/ijin-penjamin-emisi-waterfront-securities-keluar

Sekuritas Asing Targetkan Saham SIMP di Rp1.800

http://pasarmodal.inilah.com/read/detail/1785150/sekuritas-asing-targetkan-saham-simp-di-rp1800

Asing Masuk, CFIN Bakal Dikerek ke Rp650

http://pasarmodal.inilah.com/read/detail/1785151/asing-masuk-cfin-bakal-dikerek-ke-rp650

Laba Naik 305%, Cermati Saham BRAU

http://pasarmodal.inilah.com/read/detail/1785152/laba-naik-305-cermati-saham-brau

Minta Jatah Lebih, Glencore Bantu Bakrie US$900Jt

http://pasarmodal.inilah.com/read/detail/1785157/minta-jatah-lebih-glencore-bantu-bakrie-us900jt

Indeks IDMA reli selama enam hari seiring penurunan CDS

http://investasi.kontan.co.id/v2/read/1318563892/79999/Indeks-IDMA-reli-selama-enam-hari-seiring-penurunan-CDS

LPKR siapkan dana Rp 600 miliar untuk buyback saham

http://investasi.kontan.co.id/v2/read/1318560473/79993/LPKR-siapkan-dana-Rp-600-miliar-untuk-buyback-saham

TFCO menambah kapasitas produksi fiber dan filamen

http://investasi.kontan.co.id/v2/read/1318557599/79983/TFCO-menambah-kapasitas-produksi-fiber-dan-filamen

9:03 AM 10/14 Trades of the Day... Fundamentally: CIMB mempertahankan rating sektor perbankan pada NEUTRAL dengan top pick kami pada BMRI, BBNI dan BBKP masing-masing dengan TP Rp9400, 5200, 1200. Prediksi pertumbuhan kredit tahun 2012 kami turunkan ke 20-22% dari 23-24%, karena turunnya GDP oleh ekonomis kami dari 6.6% menjadi 6.2%. Setelah BI rate turun kemarin, rate gap negara kita menjadi lebih kecil sehingga meningkatkan resiko. Kepemilikan asing di SUN telah turun dari 36% menjadi 31% dalam beberapa bulan (vs 15-25% pada 2009-10), namun resiko cash-out masih ada. Kami menyarankan investor untuk fokus pada bank yang memiliki high earning growth. Dari regresi analysis kami melihat kecilnya korelasi antara turunnya suku bunga dengan pertumbuhan kredit, seperti yang terjadi pada 2006, 2008 dan 2009

9:09 AM 10/14 DBS High Conviction Stock Picks - Big Caps: BBNI TP 5.000, BBRI TP 8.550, ITMG TP 49.450 (selengkapnya saya kirim lewat email)

9:14 AM 10/14 Jakarta - PT Berau Coal Energy Tbk (BRAU) dikabarkan membukukan peningkatan laba usaha sebesar 305% hingga kuartal 3-2011 menjadi US$135 juta. Naiknya volume penjualan dan ditemukannya cadangan baru menjadi faktor pendorong kenaikan laba usaha tersebut. Selain itu, BRAU dikabarkan akan membagikan dividen Rp25 per saham yang akan diumumkan pada 21 Oktober mendatang. Pada perdagangan kemarin saham BRAU ditutup naik Rp10 ke Rp460.

http://pasarmodal.inilah.com/read/detail/1785415/hmm-wall-street-terangkat-data-penjualan-ritel

Aksi Jual Mendera, IHSG Melemah 0,2%. net foreign sell Rp169,1 miliar

http://pasarmodal.inilah.com/read/detail/1785320/aksi-jual-mendera-ihsg-melemah-02

Profit Taking Saham Unggulan Gerus IHSG 10 Poin

http://finance.detik.com/read/2011/10/14/160708/1744241/6/profit-taking-saham-unggulan-gerus-ihsg-10-poin

Inilah Daftar 'Net Foreign Buy' Jumat (14/10)

http://pasarmodal.inilah.com/read/detail/1785389/inilah-daftar-net-foreign-buy-jumat-1410

Inilah Daftar 'Net Foreign Sell' Jumat (14/10)

http://pasarmodal.inilah.com/read/detail/1785374/inilah-daftar-net-foreign-sell-jumat-1410

INCO Bagi Dividen Interim 2011 US$100 Juta

http://pasarmodal.inilah.com/read/detail/1785377/inco-bagi-dividen-interim-2011-us100-juta

ASGR Bagi Dividen Interim Rp12/Saham

http://pasarmodal.inilah.com/read/detail/1785373/asgr-bagi-dividen-interim-rp12saham

GMTD akan bayar dividen Rp 38 per saham

http://investasi.kontan.co.id/v2/read/1318574659/80024/GMTD-akan-bayar-dividen-Rp-38-per-saham-

Pasar Berspekulasi Soal Pertemuan G20

http://pasarmodal.inilah.com/read/detail/1785362/pasar-berspekulasi-soal-pertemuan-g20

Duh! 28 Emiten Telat Sampaikan LKTT

http://pasarmodal.inilah.com/read/detail/1785314/duh-28-emiten-telat-sampaikan-lktt

Syarat Kurang, Rights Issue MYOH Ditunda

http://finance.detik.com/read/2011/10/14/162523/1744265/6/syarat-kurang-rights-issue-myoh-ditunda

Induk TvOne Cs Dapat Izin Pra Efektif IPO

http://finance.detik.com/read/2011/10/14/144558/1744169/6/induk-tvone-cs-dapat-izin-pra-efektif-ipo

Antam Olah Emas dan Perak Tambang Martabe

http://finance.detik.com/read/2011/10/14/132000/1744062/6/antam-olah-emas-dan-perak-tambang-martabe

DJ Astra International Raised To Overweight vs Neutral By HSBC. Target Cut Tp Rp 75.000 vs Rp 76.000 By HSBC.

1st session JCI on 14.10.11

3661.18(-14.20pts)(-0.38%)

(H: 3688.14 ; L: 3658.93 )

Value: 2.94T (NG 1.69T )

Volume: 2.34 B (NG 839 M )

Foreign Nett Buy: 56 B

USD/IDR : 8865 (On Shore)

8865 (Off Shore)

6 MARKET DRIVEN BY SECTOR

MINING. (-0.70%)(1957.152 B )

FINANCE. (-0.06%)(373.175 B )

MANUFACTUR(-0.33%)(221.046 B )

INFRASTRUC. (-0.97%)(204.613 B )

PROPERTY(-0.57%)(73.882 B )

CONSUMER(-0.40%)(35.673 B )

6 NETT BUY STOCKs BY FOREIGN

BBRI. @6549. (103.78 B )

SMGR. @8843. (6.56 B )

UNTR. @23057(4.86 B )

BMRI. @6674. (3.99 B )

AALI. @18982 (3.56 B )

BDMN. @5125. (3.55 B )

6 NETT SELL STOCKs BY FOREIGN

TLKM. @7219. (33.16 B )

HRUM. @7589. (23.62 B )

PTBA. @16957. (21.63 B )

CMNP. @1503. (2.63 B )

BUMI. @2171. (2.59 B )

INCO. @3160. (2.34 B )

8 MOST ACTIVE STOCKs BY VALUE

BBRI. @6500. (+0.77%)

TLKM. @7200. (-0.69%)

BUMI. @2175. (0.00%)

ADRO. @1870. (+0.53%)

CMNP. @1500. (+2.74%)

TRAM. @790. (0.00%)

ENRG. @154. (+1.31%)

BMRI. @6600. (-0.75%)

8 MOST ACTIVE STOCKs BY VOLUME

ENRG. @154. (311.202 M )

ELTY. @116. (86.314 M )

BNBR. @52. (76.713 M )

DEWA. @80. (62.546 M )

TRAM. @790. (62.075 M )

APIC. @465. (55.072 M )

KIJA. @168. (52.460 M )

*DJ Bakrie & Brothers: Considering Repaying Or Restructuring $597 Mln Debt

JAKARTA (Dow Jones)--PT Bakrie & Brothers (BNBR.JK) is considering repaying or restructuring $597 million of debt arranged by Credit Suisse in the near future, the Indonesian holding company said Friday. The company, whose business interests include plantations, telecommunications, mining and property, said it is in "continuous discussions" with related parties on the debt.

GMTD akan bayar dividen Rp 38 per saham Batas akhir perdagangan saham dengan hak dividen atau cum dividen di pasar reguler dan pasar negosiasi hingga 2 November 2011. Sementara, cum dividen di pasar tunai sampai 7 November 2011.

Beli Asing Gagal Akhiri IHSG Sesi I di Zona Hijau. net foreign buy Rp55,54 miliar.

http://pasarmodal.inilah.com/read/detail/1785218/beli-asing-gagal-akhiri-ihsg-sesi-i-di-zona-hijau

Investor Tunggu Hasil G20, IHSG Menipis 14 Poin

http://finance.detik.com/read/2011/10/14/113617/1743982/6/investor-tunggu-hasil-g20-ihsg-menipis-14-poin

Sesi Dua, Pilih Saham 'Second Liner'

http://pasarmodal.inilah.com/read/detail/1785216/sesi-dua-pilih-saham-second-liner

Emisi Efek Baru Capai Rp 68,26 Triliun Hingga Oktober

http://finance.detik.com/read/2011/10/14/114211/1743991/6/emisi-efek-baru-capai-rp-6826-triliun-hingga-oktober

Agenda 14 Oktober CHANDRA ASRI PETROCHEMICAL (TPIA) DIVIDEND, RP 14,5 CUM, rupslb myoh 17 Oktober BANK MAYAPADA INTERNASIONAL RUPSLB, Masyarakat Energi Terbarukan Indonesia (METI) akan menyelenggarakan pertemuan para pakar dan praktisi energi terbarukan dan efisiensi energi tingkat dunia di Bali, 17-19 Oktober 2011, METRO REALTY STOCK SPLIT, RASIO 4:1

Bloomberg: Palm Oil Gains, Set for First Weekly Advance in Four on Demand

Bloomberg: Indofood CBP Sales May Rise on Thai Floods: Standard Chartered

Bloomberg: Indonesia Bonds Head for Weekly Gain on Inflows; Rupiah Steady

Bloomberg: Bank Negara Indonesia, NWS Added to Citi’s Top Quant Buy List

Bloomberg: Emerging Stock Fund Outflows Slow on Policy Steps, Citi Says

Bloomberg: Nusantara Joins 11.7 Trillion Rupiah Port Tender, Daily Reports

Bloomberg: Indonesia to Reintroduce Stock Options Next Year, Bourse Says

Sentimen Eropa Negatif, IHSG Dibuka Turun 0,12%

http://pasarmodal.inilah.com/read/detail/1785166/sentimen-eropa-negatif-ihsg-dibuka-turun-012

Inilah Saham-saham Berpeluang Profit Taking

http://pasarmodal.inilah.com/read/detail/1785159/inilah-saham-saham-berpeluang-profit-taking

Raup Pinjaman Glencore, 'Speculative Buy' BNBR

http://pasarmodal.inilah.com/read/detail/1785168/raup-pinjaman-glencore-speculative-buy-bnbr

Stagnasi Ekonomi Negara Besar Bertahan Hingga 2012

http://pasarmodal.inilah.com/read/detail/1785190/stagnasi-ekonomi-negara-besar-bertahan-hingga-2012

IHSG 4.000-4.100, Probabilitas 70 Persen

http://pasarmodal.inilah.com/read/detail/1784988/ihsg-4000-4100-probabilitas-70-persen

Kabar Negatif dari Spanyol, IHSG Bisa Terkoreksi Lagi

http://finance.detik.com/read/2011/10/14/072613/1743792/6/kabar-negatif-dari-spanyol-ihsg-bisa-terkoreksi-lagi

Alfamart Private Placement Minimal Rp 3.386 per Saham

http://finance.detik.com/read/2011/10/14/101248/1743903/6/alfamart-private-placement-minimal-rp-3386-per-saham

Lippo Karawaci Siapkan Rp 600 Miliar untuk Buyback Saham

http://finance.detik.com/read/2011/10/14/104713/1743921/6/lippo-karawaci-siapkan-rp-600-miliar-untuk-buyback-saham

Rumor suplai suku cadang terganggu menyebabkan saham ASII turun

http://investasi.kontan.co.id/v2/read/1318564240/80001/Rumor-suplai-suku-cadang-terganggu-menyebabkan-saham-ASII-turun

Saham INDF tersokong sentimen banjir Thailand

http://investasi.kontan.co.id/v2/read/1318564727/80003/Saham-INDF-tersokong-sentimen-banjir-Thailand

Ijin Penjamin Emisi Waterfront Securities Keluar

http://pasarmodal.inilah.com/read/detail/1785197/ijin-penjamin-emisi-waterfront-securities-keluar

Sekuritas Asing Targetkan Saham SIMP di Rp1.800

http://pasarmodal.inilah.com/read/detail/1785150/sekuritas-asing-targetkan-saham-simp-di-rp1800

Asing Masuk, CFIN Bakal Dikerek ke Rp650

http://pasarmodal.inilah.com/read/detail/1785151/asing-masuk-cfin-bakal-dikerek-ke-rp650

Laba Naik 305%, Cermati Saham BRAU

http://pasarmodal.inilah.com/read/detail/1785152/laba-naik-305-cermati-saham-brau

Minta Jatah Lebih, Glencore Bantu Bakrie US$900Jt

http://pasarmodal.inilah.com/read/detail/1785157/minta-jatah-lebih-glencore-bantu-bakrie-us900jt

Indeks IDMA reli selama enam hari seiring penurunan CDS

http://investasi.kontan.co.id/v2/read/1318563892/79999/Indeks-IDMA-reli-selama-enam-hari-seiring-penurunan-CDS

LPKR siapkan dana Rp 600 miliar untuk buyback saham

http://investasi.kontan.co.id/v2/read/1318560473/79993/LPKR-siapkan-dana-Rp-600-miliar-untuk-buyback-saham

TFCO menambah kapasitas produksi fiber dan filamen

http://investasi.kontan.co.id/v2/read/1318557599/79983/TFCO-menambah-kapasitas-produksi-fiber-dan-filamen

9:03 AM 10/14 Trades of the Day... Fundamentally: CIMB mempertahankan rating sektor perbankan pada NEUTRAL dengan top pick kami pada BMRI, BBNI dan BBKP masing-masing dengan TP Rp9400, 5200, 1200. Prediksi pertumbuhan kredit tahun 2012 kami turunkan ke 20-22% dari 23-24%, karena turunnya GDP oleh ekonomis kami dari 6.6% menjadi 6.2%. Setelah BI rate turun kemarin, rate gap negara kita menjadi lebih kecil sehingga meningkatkan resiko. Kepemilikan asing di SUN telah turun dari 36% menjadi 31% dalam beberapa bulan (vs 15-25% pada 2009-10), namun resiko cash-out masih ada. Kami menyarankan investor untuk fokus pada bank yang memiliki high earning growth. Dari regresi analysis kami melihat kecilnya korelasi antara turunnya suku bunga dengan pertumbuhan kredit, seperti yang terjadi pada 2006, 2008 dan 2009

9:09 AM 10/14 DBS High Conviction Stock Picks - Big Caps: BBNI TP 5.000, BBRI TP 8.550, ITMG TP 49.450 (selengkapnya saya kirim lewat email)

9:14 AM 10/14 Jakarta - PT Berau Coal Energy Tbk (BRAU) dikabarkan membukukan peningkatan laba usaha sebesar 305% hingga kuartal 3-2011 menjadi US$135 juta. Naiknya volume penjualan dan ditemukannya cadangan baru menjadi faktor pendorong kenaikan laba usaha tersebut. Selain itu, BRAU dikabarkan akan membagikan dividen Rp25 per saham yang akan diumumkan pada 21 Oktober mendatang. Pada perdagangan kemarin saham BRAU ditutup naik Rp10 ke Rp460.

9:14 AM 10/14 Jakarta - Saham PT Clipan Tbk (CFIN) dikabarkan bakal dikerek bandar ke level Rp650 dalam waktu dekat. Hal ini seiring kabar akan masuknya investor strategis asing ke perseroan. Selain itu, penerbitan obligasi untuk ekspansi usaha juga menjadi sentimen positif ke saham CFIN. Pada perdagangan kemarin saham CFIN ditutup naik Rp50 ke level Rp435.

Thursday, October 13, 2011

Another Similar 2008 Chart Pattern

“He observed that human emotions collectively had major impacts on the movement of stock prices and markets in general, ultimately creating patterns that kept repeating.” - From a book on Jesse Livermore’s trading style. Without a doubt one common similarity between the current market and the fall of 2008 is heightened investor emotions. There are plenty of other similarities from bank nationalizations, a deteriorating global economy and government intervention.

READ MORE: http://www.zerohedge.com/news/guest-post-another-similar-2008-chart-pattern

Marc Faber: Long The Dollar, But Occupy The Federal Reserve

Marc Faber, asset manager at the Gloom, Doom & Boom Report, popped in at CNBC (Clip Below) on Oct. 11 while visiting in Montreal, Canada (He is usually based in Thailand.). Faber expects volatility to continue (not necessarily mean a downside to the market), but dollar should be a long trade as whenever there's a bubble, e.g. tech bubble, housing bubble, stocks bubble, and commodities bubble, usually after the bubble bursts, there typically will be a 10-15 years of volatility before markets settle down to reignite an uptrend.

READ MORE: http://www.econmatters.com/2011/10/marc-faber-long-dollar-but-occupy.html

A Chartbook of 3 Financial Market Crises

Everybody is asking where to now with the global financial markets. I thought it was worthwhile comparing the current behavior of the financial markets with the two recent crises, namely the great financial crisis of 2008/2009 and the minor one in 2010 when the sovereign debt crisis in the Eurozone developed. I have charted the series starting with two months before each crisis developed and ended the series 11 months later. The respective series are as follows:

* 2008 crisis: July 2008 to July 2009

* 2010 crisis: February 2010 to February 2011

* 2011 crisis: from May 2011

READ MORE: http://www.econmatters.com/2011/10/chartbook-of-3-financial-market-crises.html

READ MORE: http://www.zerohedge.com/news/guest-post-another-similar-2008-chart-pattern

Marc Faber: Long The Dollar, But Occupy The Federal Reserve

Marc Faber, asset manager at the Gloom, Doom & Boom Report, popped in at CNBC (Clip Below) on Oct. 11 while visiting in Montreal, Canada (He is usually based in Thailand.). Faber expects volatility to continue (not necessarily mean a downside to the market), but dollar should be a long trade as whenever there's a bubble, e.g. tech bubble, housing bubble, stocks bubble, and commodities bubble, usually after the bubble bursts, there typically will be a 10-15 years of volatility before markets settle down to reignite an uptrend.

READ MORE: http://www.econmatters.com/2011/10/marc-faber-long-dollar-but-occupy.html

A Chartbook of 3 Financial Market Crises

Everybody is asking where to now with the global financial markets. I thought it was worthwhile comparing the current behavior of the financial markets with the two recent crises, namely the great financial crisis of 2008/2009 and the minor one in 2010 when the sovereign debt crisis in the Eurozone developed. I have charted the series starting with two months before each crisis developed and ended the series 11 months later. The respective series are as follows:

* 2008 crisis: July 2008 to July 2009

* 2010 crisis: February 2010 to February 2011

* 2011 crisis: from May 2011

READ MORE: http://www.econmatters.com/2011/10/chartbook-of-3-financial-market-crises.html

Laporan & Rumor Saham Indonesia 13-10 (Refresh)

*DJ Indonesia President: Reshuffle Plan Supported By Parties In Coalition

*DJ Indonesia President: Reshuffle Will Be Announced In Next Few Days

[Dow Jones] Indonesia rupiah-denominated government bonds are higher across the board amid improving sentiment for riskier emerging-markets assets. "Domestic inflation is easing and will likely remain manageable below 5% this year. So even when after BI cut its key rate to 6.50%; it still gives a more than 150bp spread," a local trader says. He adds profit-taking may hit the long-term notes after recent gains. The five-year yield falls to 5.82% from 6.0% Wednesday, the 10-year yield is at 6.31% vs 6.52%, the 15-year yield is at 6.94% vs 6.95% and the 20-year yield is at 7.15% vs 7.26%. (andreasismar.sandiwan@dowjones.com)

2nd session JCI on 13.10.11

3675.38(+39.45pts)(+1.08%)

(H: 3702.75 ; L: 3636.57 )

Value: 5.98T (NG 278 B )

Volume: 3.80 B (NG 166 M )

Foreign Nett Buy: 944 B !!!

USD/IDR : 8865(On Shore)

8870(Off Shore)

6 MARKET DRIVEN BY SECTOR

MINING. (+2.17%)(1827.929 B )

FINANCE. (+0.87%)(1227.753 B )

MANUFACTUR (+1.10%)(1188.225 B )

INFRASTRUC. (+0.17%)(650.033 B )

PROPERTY. (+0.92%)(448.985 B )

CONSUMER. (-0.44%)(343.947 B )

6 NETT BUY STOCKs BY FOREIGN

BUMI. @2211. (166.20 B )

ASII. @67127 (125.24 B )

BMRI. @6690. (72.38 B )

BBNI. @3688. (71.48 B )

PTBA. @17018. (68.90 B )

UNTR. @23237 (55.27 B )

6 NETT SELL STOCKs BY FOREIGN

TLKM. @7242. (102.11 B )

JSMR. @3814. (24.13 B )

GGRM. @58745. (14.34 B )

DOID. @630. (10.51 B )

CFIN. @421. (6.87 B )

LSIP. @2054. (6.66 B )

8 MOST ACTIVE STOCKs BY VALUE

BUMI. @2175. (+1.16%)

ASII. @67900 (+2.95%)

BMRI. @6650. (0.00%)

ADRO. @1860. (0.00%)

ENRG. @152. (-3.18%)

BBRI. @6450. (0.00%)

TLKM. @7250. (-1.36%)

BBKP. @630. (+12.50%)

8 MOST ACTIVE STOCKs BY VOLUME

ENRG. @152. (1.404 B )

ELTY. @116. (737.260 M )

BNBR. @53. (718.010 M )

KIJA. @170. (487.472 M )

DEWA. @79. (395.238 M )

CFIN-W. @70. (243.485 M )

BBKP. @630. (238.789 M )

BUMI. @2175 (228.857 M )

Asing Tambah Posisi, IHSG Menguat 1%. Net foreign buy Rp908,1 miliar

http://pasarmodal.inilah.com/read/detail/1784900/asing-tambah-posisi-ihsg-menguat-1

Penghijauan sembilan sektor angkat indeks sebesar 1% di sesi sore

http://investasi.kontan.co.id/v2/read/1318496403/79927/Penghijauan-sembilan-sektor-angkat-indeks-sebesar-1-di-sesi-sore

IHSG Gagal Bertahan di Level 3.700

http://finance.detik.com/read/2011/10/13/160825/1743487/6/ihsg-gagal-bertahan-di-level-3700

Aksi Ambil Untung Tekan Bursa Eropa

http://pasarmodal.inilah.com/read/detail/1784880/aksi-ambil-untung-tekan-bursa-eropa

Inilah Target Jangka Pendek Saham Tambang

http://pasarmodal.inilah.com/read/detail/1784852/inilah-target-jangka-pendek-saham-tambang

Target Harga Saham Astra, Semen & Infrastruktur

http://pasarmodal.inilah.com/read/detail/1784865/target-harga-saham-astra-semen-infrastruktur

Grup Ciputra Anggarkan Capex Rp2 T di 2012

http://pasarmodal.inilah.com/read/detail/1784814/grup-ciputra-anggarkan-capex-rp2-t-di-2012

Adaro Beli 35% Saham Servo Meda Sejahtera

http://pasarmodal.inilah.com/read/detail/1784768/adaro-beli-35-saham-servo-meda-sejahtera

Total Penjualan Grup Ciputra Capai Rp3,14 T

http://pasarmodal.inilah.com/read/detail/1784778/total-penjualan-grup-ciputra-capai-rp314-t

Strategi untuk BDMN, BBNI dan BJBR

http://pasarmodal.inilah.com/read/detail/1784842/strategi-untuk-bdmn-bbni-dan-bjbr

Carrefour Kejar Saham Publik ALFA Pasca Tender Offer

http://finance.detik.com/read/2011/10/13/122318/1743190/6/carrefour-kejar-saham-publik-alfa-pasca-tender-offer

Pekan ini, ENRG mulai pasok 2,5 juta kubik gas ke PLN

http://investasi.kontan.co.id/v2/read/1318497068/79929/Pekan-ini-ENRG-mulai-pasok-25-juta-kubik-gas-ke-PLN

TINS tengah melakukan renegosiasi harga dengan buyer Asia

http://investasi.kontan.co.id/v2/read/1318493418/79919/TINS-tengah-melakukan-renegosiasi-harga-dengan-buyer-Asia

Credit Suisse pangkas proyeksi, saham GGRM jatuh 3,8%

http://investasi.kontan.co.id/v2/read/1318490943/79914/Credit-Suisse-pangkas-proyeksi-saham-GGRM-jatuh-38

PT Timah in Talks With LG, Asian Buyers to Resume Tin Shipments

Oct. 13 (Bloomberg) -- PT Timah, Indonesia’s largest tin producer, is renegotiating prices with Asian buyers including LG International Corp. as the company prepares to resume contractual shipments, according to an executive. Timah wants buyers to agree on prices of more than $23,000 per metric ton, said Abrun Abubakar, corporate secretary at the Pangkalpinang-based company. Spot sales overseas will remain halted until the price reaches $25,000, he said by phone today. Timah joined Indonesian producers in suspending shipments from the country on Oct. 1 in a bid to reverse a rout in prices by choking off supplies to the global market.

CLSA:::: Alam Sutera (ASRI IJ) marketing sales in 9M11 reached Rp2.3tn ($258m), 92% of FY11 target of Rp2.5tn (+56% YoY). ASRI had raised this target from Rp1.75tn before. Comment: ASRI will launch its Pasar Kemis township in October, aiming to get Rp200bn pre-sales from the initial launch. ASRI has ~1,000ha land bank in Pasar Kemis. ASRI is trading at 24% discount to company’s NAV of Rp560/sh.

Credit Suisse::: 1) STRATEGY: Risk to lag when the dust settles?

@JCI 3,636pts, CS Indonesia Universe is trading on 13.5x-11.7x 11F-12F PER on the back of 27%-15% EPS Growth, with 4-years Fibonacci trading range now 3,463pts-4,196pts. I agree with Teddy to accumulate Financial (BMRI, BBRI, then BTPN, BBNI and BBCA), Material (PTBA, ITMG, HRUM and SMGR), and Industrial (UNTR). Hold ASII as Thailand flood may have negative sentiment more than earnings downside. I continue to agree with Teddy Oetomo Indonesia is still trading at a premium to peers, combined with its relatively thin trading liquidity, the Indonesia market may continue to be exposed to the high volatility ahead given the current global financial market uncertainty. Buy on Weakness Indonesia!

JAKARTA (Dow Jones)--PT Energi Mega Persada (ENRG.JK) said Thursday that it will start supplying 2.5 million standard cubic feet per day of gas from its Gelam TAC Block in Jambi on Sumatra island to state electricity company PLN by the end of this week. Energi Mega will sell the gas at $4.9 per million British thermal units, it said in a statement. The contract, which is for six years, also stipulates a 3% annual price increase. The agreement came amid rising demand for gas in Indonesia. PLN has been eager to lock in gas supplies to reduce its dependancy on costlier diesel and coal.

MARKET TALK: EUR/USD May Fall If Italian Bond Tender Results Poor

[Dow Jones] Indonesian shares are up 1.6% at 3692.682 in moderate volume midday, as foreigners continue snapping up most blue chips amid hopes the recent interest-rate cut will boost most companies' earnings, traders say. They expect the main index to find resistance at 3700. "If foreign buying continues, the main index could even easily break the important level of 3700 and may test the next resistance at 3730," says an analyst with a local securities firm. Foreigners are net buyers of IDR444 billion worth of shares so far. Among gainers, car maker Astra (ASII.JK) is up 2.3% at IDR67,450, food producer Indofood (INDF.JK) is up 5.7% at IDR5,600, while Bank Negara (BBNI.JK) is up 2.8% at IDR3,700. Profit-taking hits cigarette maker Gudang Garam (GGRM.JK), which is down 4.1% at IDR58,500. (edhi.pranasidhi@dowjones.com)

1st session JCI on 13.10.11

3692.68(+56.75pts)(+1.56%)

(H: 3696.06 ; L: 3636.57 )

Value: 3.11T. (NG 141 B )

Volume: 521M (NG 89 M )

Foreign Nett Buy: 444 B

USD/IDR : 8920. (On Shore)

8907.5 (Off Shore)

6 MARKET DRIVEN BY SECTOR

MINING. (+2.68%)(993.460 B )

FINANCE. (+1.50%)(637.273 B )

MANUFACTUR(+1.50%)(559.823 B )

INFRASTRUC. (+0.13%)(292.792 B )

PROPERTY. (+1.07%)(269.449 B )

CONSUMER. (+0.51%)(160.575 B )

6 NETT BUY STOCKs BY FOREIGN

BUMI. @2204. (88.05 B )

BBRI. @6528. (45.90 B )

ASII. @66716. (32.75 B )

INDF. @5525. (31.24 B )

UNTR. @23188 (29.89 B )

ADRO. @1873. (23.53 B )

6 NETT SELL STOCKs BY FOREIGN

TLKM. @7256. (32.33 B )

GGRM. @59064(11.60 B )

LSIP. @2055. (4.71 B )

DOID. @635. (4.06 B )

CMNP. @1471. (3.96 B )

ELTY. @122. (3.41 B )

8 MOST ACTIVE STOCKs BY VALUE

BUMI. @2250. (+4.65%)

ASII. @67450. (+2.27%)

ENRG. @161. (+2.54%)

BMRI. @6700. (+0.75%)

BBRI. @6500. (+0.77%)

ADRO. @1880. (+1.07%)

BBKP. @630. (+12.50%)

BBNI. @3700. (+2.77%)

8 MOST ACTIVE STOCKs BY VOLUME

ENRG. @161. (952.415 M )

BNBR. @54. (544.314 M )

ELTY. @120. (442.392 M )

KIJA. @174. (333.616 M )

DEWA. @83. (263.240 M )

BBKP. @630. (164.941 M )

ENRG-W@46. (151.635 M )

CFIN-W. @69. (150.340 M )

*DJ IMF: Greater Currency Appreciation Would Help Manage Inflation

*DJ IMF: Inflation Seen Peaking In 2H 2011, Falling Gradually 2012

*DJ IMF: Any China Stimulus Should Target Consumption Not Investment

*DJ IMF: China Can Deliver More Fiscal Stimulus If Necessary

*DJ IMF: Worse Euro-Zone Turbulence Poses 'Extreme' Risk For Asia

*DJ IMF: Asia Near-Term Risks 'Tilted Decidedly To The Downside'

*DJ IMF: Resilient Domestic Demand To Continue To Buoy Asian Growth

*DJ IMF: Credit Growth Remains Elevated Across Emerging Asia

*DJ IMF: Overheating Still A Concern In China, HK, Indonesia

*DJ IMF: Asia-Pacific Inflationary Pressures Remain Elevated

REMINDER:::: 13 Oktober BW PLANTATION DIVIDEND, RP 9 CUM, BUMI TO COMPLETE FIRST-TRANCHE REPAYMENT OF $600 MILLION OF DEBT TO CIC BY THURSDAY ,Cum Right Issue KIJA 500:219 (250)

*DJ Perusahaan Gas Target Cut To IDR3050 Vs IDR5000 By Citigroup

Bloomberg: *PALM OIL DROPS AS MUCH AS 0.6% TO 2,848 RINGGIT A METRIC TON

Bloomberg: China Export Growth Slowest Since Feb, Trade Surplus Misses Est.

CLSA:::: International Nickel Indonesia (INCO IJ) inaugurates US$410m hydro power plant in South Sulawesi. The hydro power plant is an important part of the infrastructure needed for INCO’s production expansion from 73,000 tons to 120,000 tons over the next five years. INCO plans to invest a total of US$2bn for new projects in Indonesia. Aside from nickel, INCO plans to diversify to copper, bauxite and coal. Comment: The commitment for additional investment comes as a new management team has been appointed at INCO. The plan to produce additional minerals and coal is reportedly at its existing Contract of Work site.

*DJ Magnitude 6 Quake Strikes Off Indonesia's Bali Island -USGS

*DJ Indonesia Agency: 6.8 Richter Scale Quake, 143km Southwest Bali, No Tsunami

CLSA::: Regulator BPMigas wants Perusahaan Gas Negara (PGAS IJ) to sell expensive gas. Upstream oil and gas regulator BPMigas is encouraging PGAS to buy 140mmscfd LNG from the BP Plc (BP LN) led Tangguh LNG project in Papua at US$9/mmbtu to US$10/mmbtu. BPMigas continues to urge PGAS to renegotiate their existing contracts to a market price of US$5/mmbtu to US$6/mmbtu to increase government revenues. BPMigas estimates the legacy contracts cost the government US$4bn per year in lost revenues. Comment: BPMigas’ has been calling for relegation of existing contracts since July/August this year. We have factored in the 140mmscfd LNG contract into our numbers coming onstream in 2013 at a cost of US$8/mmbtu with a distribution margin of US$2.5/mmbtu.

Pikko Group has mandated PT Sinarmas Sekuritas as a brokerage that helps conducting a tender offer for the remaining shares in PT Royal Oak Development Tbk (RODA).

In an official announcement yesterday, Pikko Land said Sinarmas Sekuritas will hold administrative tasks of the tender offer, including the settlement.

Pikko Land, founded in British Virgin Island, intends to hold the tender offer of 4.3 billion shares or 31.99% stake in Royal Oak, following a 68.01% take over.

Fundamentally:

CIMB menurunkan rating sektor mining dari OVERWEIGHT menjadi UNDERWEIGHT. Setelah koreksi 5 bulan berturut turut, nickel merupakan logam dengan kinerja terburuk di LME, dan sepertinya hal ini akan berlanjut hingga tahun depan apalagi karena global slowdown. Kami memangkas 2011-12 EPS by 5.3-53.9% pada perusahaan nickel dan memangkas ASP nickel dan target harga. Nickel akan oversupply sekitar 40k-130k ton pada 2011-12. Target harga kami sekarang adalah ANTM TP Rp1570, INCO TP Rp2950. Valuasi sektor ini menjadi 10.9 core forward PER atau 44% downside dari bottom 6.1x PER yang pernah dicapai pada 2008-09 lalu.

Bloomberg: Indonesia Cuts Guaranteed Rupiah Deposit Rate to 7% From 7.25%

Bloomberg: Rubber Futures in Tokyo Pare Earlier Gain of 1.4%

Bloomberg: Garuda Indonesia to Add 18 Planes Next Month, Kontan Reports

Bloomberg: Timah Plans to Boost Coal Output to 2 Million Tons, Kontan Says

Bloomberg: FX: SGD and MYR May Outperform USD Amid Uncertainty: Goldman

Bloomberg: Indonesia May Limit Foreign Investment in Local Mines

Bloomberg: Emerging Stocks Set for Best Six-Day Gain Since ‘09 on State Aid

Inilah Menu Saham Hari Ini

http://pasarmodal.inilah.com/read/detail/1784581/inilah-menu-saham-hari-ini

Rekomendasi Saham

IHSG Siap-siap Ikuti Penguatan Bursa Regional

http://finance.detik.com/read/2011/10/13/072608/1742888/6/ihsg-siap-siap-ikuti-penguatan-bursa-regional

Analis: IHSG akan bergerak mixed dan telah memasuki fase overbought

http://investasi.kontan.co.id/v2/read/1318470547/79858/Analis-IHSG-akan-bergerak-mixed-dan-telah-memasuki-fase-overbought

Target IHSG Berikutnya, 3.800-3.900

http://pasarmodal.inilah.com/read/detail/1784591/target-ihsg-berikutnya-3800-3900

Bursa Saham Terangkat Sentimen BI Rate

http://pasarmodal.inilah.com/read/detail/1784725/bursa-saham-terangkat-sentimen-bi-rate

Jangka Menegah, IHSG Terpangkas 'Double Digit'

http://pasarmodal.inilah.com/read/detail/1784608/jangka-menegah-ihsg-terpangkas-double-digit

Hasil Kinerja Sangat Baik, KRAS Menuju Rp 1500

http://pasarmodal.inilah.com/read/detail/1784724/hasil-kinerja-sangat-baik-kras-menuju-rp-1500

Sst.. MICE akan Buyback Saham

http://pasarmodal.inilah.com/read/detail/1784727/sst-mice-akan-buyback-saham

Bank Mandiri Klaim sudah Turunkan Bunga Kredit

http://pasarmodal.inilah.com/read/detail/1784728/bank-mandiri-klaim-sudah-turunkan-bunga-kredit

Saham BORN Berpotensi ke Rp1.450

http://pasarmodal.inilah.com/read/detail/1784731/saham-born-berpotensi-ke-rp1450

Pertumbuhan Kredit Bank Mandiri Melambat

http://pasarmodal.inilah.com/read/detail/1784735/pertumbuhan-kredit-bank-mandiri-melambat

Saham Eksportir Angkat Bursa Asia

http://pasarmodal.inilah.com/read/detail/1784740/saham-eksportir-angkat-bursa-asia

Prediksi suplai melonjak menekan pergerakan harga minyak

http://investasi.kontan.co.id/v2/read/1318466348/79851/Prediksi-suplai-melonjak-menekan-pergerakan-harga-minyak

Glencore meminta saham Bumi Plc

http://investasi.kontan.co.id/v2/read/1318465116/79848/Glencore-meminta-saham-Bumi-Plc

Harga CPO rontok, laba LSIP masih sip

http://investasi.kontan.co.id/v2/read/1318463457/79844/Harga-CPO-rontok-laba-LSIP-masih-sip

Investor melepas valuta Asia dan masuk ke dollar AS

http://investasi.kontan.co.id/v2/read/1318461498/79838/-Investor-melepas-valuta-Asia-dan-masuk-ke-dollar-AS

BATR kembali cari pinjaman US$ 500 juta

http://investasi.kontan.co.id/v2/read/1318432223/79830/BATR-kembali-cari-pinjaman-US-500-juta

ELTY akan lepas saham Bakrie Toll Road sampai Rp 2 triliun

http://investasi.kontan.co.id/v2/read/1318419607/79814/ELTY-akan-lepas-saham-Bakrie-Toll-Road-sampai-Rp-2-triliun

Harga kontrak emas kembali menanjak ke level tertinggi dua minggu

http://investasi.kontan.co.id/v2/read/1318431479/79828/Harga-kontrak-emas-kembali-menanjak-ke-level-tertinggi-dua-minggu

*DJ Indonesia President: Reshuffle Will Be Announced In Next Few Days

[Dow Jones] Indonesia rupiah-denominated government bonds are higher across the board amid improving sentiment for riskier emerging-markets assets. "Domestic inflation is easing and will likely remain manageable below 5% this year. So even when after BI cut its key rate to 6.50%; it still gives a more than 150bp spread," a local trader says. He adds profit-taking may hit the long-term notes after recent gains. The five-year yield falls to 5.82% from 6.0% Wednesday, the 10-year yield is at 6.31% vs 6.52%, the 15-year yield is at 6.94% vs 6.95% and the 20-year yield is at 7.15% vs 7.26%. (andreasismar.sandiwan@dowjones.com)

2nd session JCI on 13.10.11

3675.38(+39.45pts)(+1.08%)

(H: 3702.75 ; L: 3636.57 )

Value: 5.98T (NG 278 B )

Volume: 3.80 B (NG 166 M )

Foreign Nett Buy: 944 B !!!

USD/IDR : 8865(On Shore)

8870(Off Shore)

6 MARKET DRIVEN BY SECTOR

MINING. (+2.17%)(1827.929 B )

FINANCE. (+0.87%)(1227.753 B )

MANUFACTUR (+1.10%)(1188.225 B )

INFRASTRUC. (+0.17%)(650.033 B )

PROPERTY. (+0.92%)(448.985 B )

CONSUMER. (-0.44%)(343.947 B )

6 NETT BUY STOCKs BY FOREIGN

BUMI. @2211. (166.20 B )

ASII. @67127 (125.24 B )

BMRI. @6690. (72.38 B )

BBNI. @3688. (71.48 B )

PTBA. @17018. (68.90 B )

UNTR. @23237 (55.27 B )

6 NETT SELL STOCKs BY FOREIGN

TLKM. @7242. (102.11 B )

JSMR. @3814. (24.13 B )

GGRM. @58745. (14.34 B )

DOID. @630. (10.51 B )

CFIN. @421. (6.87 B )

LSIP. @2054. (6.66 B )

8 MOST ACTIVE STOCKs BY VALUE

BUMI. @2175. (+1.16%)

ASII. @67900 (+2.95%)

BMRI. @6650. (0.00%)

ADRO. @1860. (0.00%)

ENRG. @152. (-3.18%)

BBRI. @6450. (0.00%)

TLKM. @7250. (-1.36%)

BBKP. @630. (+12.50%)

8 MOST ACTIVE STOCKs BY VOLUME

ENRG. @152. (1.404 B )

ELTY. @116. (737.260 M )

BNBR. @53. (718.010 M )

KIJA. @170. (487.472 M )

DEWA. @79. (395.238 M )

CFIN-W. @70. (243.485 M )

BBKP. @630. (238.789 M )

BUMI. @2175 (228.857 M )

Asing Tambah Posisi, IHSG Menguat 1%. Net foreign buy Rp908,1 miliar

http://pasarmodal.inilah.com/read/detail/1784900/asing-tambah-posisi-ihsg-menguat-1

Penghijauan sembilan sektor angkat indeks sebesar 1% di sesi sore

http://investasi.kontan.co.id/v2/read/1318496403/79927/Penghijauan-sembilan-sektor-angkat-indeks-sebesar-1-di-sesi-sore

IHSG Gagal Bertahan di Level 3.700

http://finance.detik.com/read/2011/10/13/160825/1743487/6/ihsg-gagal-bertahan-di-level-3700

Aksi Ambil Untung Tekan Bursa Eropa

http://pasarmodal.inilah.com/read/detail/1784880/aksi-ambil-untung-tekan-bursa-eropa

Inilah Target Jangka Pendek Saham Tambang

http://pasarmodal.inilah.com/read/detail/1784852/inilah-target-jangka-pendek-saham-tambang

Target Harga Saham Astra, Semen & Infrastruktur

http://pasarmodal.inilah.com/read/detail/1784865/target-harga-saham-astra-semen-infrastruktur

Grup Ciputra Anggarkan Capex Rp2 T di 2012

http://pasarmodal.inilah.com/read/detail/1784814/grup-ciputra-anggarkan-capex-rp2-t-di-2012

Adaro Beli 35% Saham Servo Meda Sejahtera

http://pasarmodal.inilah.com/read/detail/1784768/adaro-beli-35-saham-servo-meda-sejahtera

Total Penjualan Grup Ciputra Capai Rp3,14 T

http://pasarmodal.inilah.com/read/detail/1784778/total-penjualan-grup-ciputra-capai-rp314-t

Strategi untuk BDMN, BBNI dan BJBR

http://pasarmodal.inilah.com/read/detail/1784842/strategi-untuk-bdmn-bbni-dan-bjbr

Carrefour Kejar Saham Publik ALFA Pasca Tender Offer

http://finance.detik.com/read/2011/10/13/122318/1743190/6/carrefour-kejar-saham-publik-alfa-pasca-tender-offer

Pekan ini, ENRG mulai pasok 2,5 juta kubik gas ke PLN

http://investasi.kontan.co.id/v2/read/1318497068/79929/Pekan-ini-ENRG-mulai-pasok-25-juta-kubik-gas-ke-PLN

TINS tengah melakukan renegosiasi harga dengan buyer Asia

http://investasi.kontan.co.id/v2/read/1318493418/79919/TINS-tengah-melakukan-renegosiasi-harga-dengan-buyer-Asia

Credit Suisse pangkas proyeksi, saham GGRM jatuh 3,8%

http://investasi.kontan.co.id/v2/read/1318490943/79914/Credit-Suisse-pangkas-proyeksi-saham-GGRM-jatuh-38

PT Timah in Talks With LG, Asian Buyers to Resume Tin Shipments

Oct. 13 (Bloomberg) -- PT Timah, Indonesia’s largest tin producer, is renegotiating prices with Asian buyers including LG International Corp. as the company prepares to resume contractual shipments, according to an executive. Timah wants buyers to agree on prices of more than $23,000 per metric ton, said Abrun Abubakar, corporate secretary at the Pangkalpinang-based company. Spot sales overseas will remain halted until the price reaches $25,000, he said by phone today. Timah joined Indonesian producers in suspending shipments from the country on Oct. 1 in a bid to reverse a rout in prices by choking off supplies to the global market.

CLSA:::: Alam Sutera (ASRI IJ) marketing sales in 9M11 reached Rp2.3tn ($258m), 92% of FY11 target of Rp2.5tn (+56% YoY). ASRI had raised this target from Rp1.75tn before. Comment: ASRI will launch its Pasar Kemis township in October, aiming to get Rp200bn pre-sales from the initial launch. ASRI has ~1,000ha land bank in Pasar Kemis. ASRI is trading at 24% discount to company’s NAV of Rp560/sh.

Credit Suisse::: 1) STRATEGY: Risk to lag when the dust settles?

@JCI 3,636pts, CS Indonesia Universe is trading on 13.5x-11.7x 11F-12F PER on the back of 27%-15% EPS Growth, with 4-years Fibonacci trading range now 3,463pts-4,196pts. I agree with Teddy to accumulate Financial (BMRI, BBRI, then BTPN, BBNI and BBCA), Material (PTBA, ITMG, HRUM and SMGR), and Industrial (UNTR). Hold ASII as Thailand flood may have negative sentiment more than earnings downside. I continue to agree with Teddy Oetomo Indonesia is still trading at a premium to peers, combined with its relatively thin trading liquidity, the Indonesia market may continue to be exposed to the high volatility ahead given the current global financial market uncertainty. Buy on Weakness Indonesia!

JAKARTA (Dow Jones)--PT Energi Mega Persada (ENRG.JK) said Thursday that it will start supplying 2.5 million standard cubic feet per day of gas from its Gelam TAC Block in Jambi on Sumatra island to state electricity company PLN by the end of this week. Energi Mega will sell the gas at $4.9 per million British thermal units, it said in a statement. The contract, which is for six years, also stipulates a 3% annual price increase. The agreement came amid rising demand for gas in Indonesia. PLN has been eager to lock in gas supplies to reduce its dependancy on costlier diesel and coal.

MARKET TALK: EUR/USD May Fall If Italian Bond Tender Results Poor

[Dow Jones] Indonesian shares are up 1.6% at 3692.682 in moderate volume midday, as foreigners continue snapping up most blue chips amid hopes the recent interest-rate cut will boost most companies' earnings, traders say. They expect the main index to find resistance at 3700. "If foreign buying continues, the main index could even easily break the important level of 3700 and may test the next resistance at 3730," says an analyst with a local securities firm. Foreigners are net buyers of IDR444 billion worth of shares so far. Among gainers, car maker Astra (ASII.JK) is up 2.3% at IDR67,450, food producer Indofood (INDF.JK) is up 5.7% at IDR5,600, while Bank Negara (BBNI.JK) is up 2.8% at IDR3,700. Profit-taking hits cigarette maker Gudang Garam (GGRM.JK), which is down 4.1% at IDR58,500. (edhi.pranasidhi@dowjones.com)

1st session JCI on 13.10.11

3692.68(+56.75pts)(+1.56%)

(H: 3696.06 ; L: 3636.57 )

Value: 3.11T. (NG 141 B )

Volume: 521M (NG 89 M )

Foreign Nett Buy: 444 B

USD/IDR : 8920. (On Shore)

8907.5 (Off Shore)

6 MARKET DRIVEN BY SECTOR

MINING. (+2.68%)(993.460 B )

FINANCE. (+1.50%)(637.273 B )

MANUFACTUR(+1.50%)(559.823 B )

INFRASTRUC. (+0.13%)(292.792 B )

PROPERTY. (+1.07%)(269.449 B )

CONSUMER. (+0.51%)(160.575 B )

6 NETT BUY STOCKs BY FOREIGN

BUMI. @2204. (88.05 B )

BBRI. @6528. (45.90 B )

ASII. @66716. (32.75 B )

INDF. @5525. (31.24 B )

UNTR. @23188 (29.89 B )

ADRO. @1873. (23.53 B )

6 NETT SELL STOCKs BY FOREIGN

TLKM. @7256. (32.33 B )

GGRM. @59064(11.60 B )

LSIP. @2055. (4.71 B )

DOID. @635. (4.06 B )

CMNP. @1471. (3.96 B )

ELTY. @122. (3.41 B )

8 MOST ACTIVE STOCKs BY VALUE

BUMI. @2250. (+4.65%)

ASII. @67450. (+2.27%)

ENRG. @161. (+2.54%)

BMRI. @6700. (+0.75%)

BBRI. @6500. (+0.77%)

ADRO. @1880. (+1.07%)

BBKP. @630. (+12.50%)

BBNI. @3700. (+2.77%)

8 MOST ACTIVE STOCKs BY VOLUME

ENRG. @161. (952.415 M )

BNBR. @54. (544.314 M )

ELTY. @120. (442.392 M )

KIJA. @174. (333.616 M )

DEWA. @83. (263.240 M )

BBKP. @630. (164.941 M )

ENRG-W@46. (151.635 M )

CFIN-W. @69. (150.340 M )

*DJ IMF: Greater Currency Appreciation Would Help Manage Inflation

*DJ IMF: Inflation Seen Peaking In 2H 2011, Falling Gradually 2012

*DJ IMF: Any China Stimulus Should Target Consumption Not Investment

*DJ IMF: China Can Deliver More Fiscal Stimulus If Necessary

*DJ IMF: Worse Euro-Zone Turbulence Poses 'Extreme' Risk For Asia

*DJ IMF: Asia Near-Term Risks 'Tilted Decidedly To The Downside'

*DJ IMF: Resilient Domestic Demand To Continue To Buoy Asian Growth

*DJ IMF: Credit Growth Remains Elevated Across Emerging Asia

*DJ IMF: Overheating Still A Concern In China, HK, Indonesia

*DJ IMF: Asia-Pacific Inflationary Pressures Remain Elevated

REMINDER:::: 13 Oktober BW PLANTATION DIVIDEND, RP 9 CUM, BUMI TO COMPLETE FIRST-TRANCHE REPAYMENT OF $600 MILLION OF DEBT TO CIC BY THURSDAY ,Cum Right Issue KIJA 500:219 (250)

*DJ Perusahaan Gas Target Cut To IDR3050 Vs IDR5000 By Citigroup

Bloomberg: *PALM OIL DROPS AS MUCH AS 0.6% TO 2,848 RINGGIT A METRIC TON

Bloomberg: China Export Growth Slowest Since Feb, Trade Surplus Misses Est.

CLSA:::: International Nickel Indonesia (INCO IJ) inaugurates US$410m hydro power plant in South Sulawesi. The hydro power plant is an important part of the infrastructure needed for INCO’s production expansion from 73,000 tons to 120,000 tons over the next five years. INCO plans to invest a total of US$2bn for new projects in Indonesia. Aside from nickel, INCO plans to diversify to copper, bauxite and coal. Comment: The commitment for additional investment comes as a new management team has been appointed at INCO. The plan to produce additional minerals and coal is reportedly at its existing Contract of Work site.

*DJ Magnitude 6 Quake Strikes Off Indonesia's Bali Island -USGS

*DJ Indonesia Agency: 6.8 Richter Scale Quake, 143km Southwest Bali, No Tsunami

CLSA::: Regulator BPMigas wants Perusahaan Gas Negara (PGAS IJ) to sell expensive gas. Upstream oil and gas regulator BPMigas is encouraging PGAS to buy 140mmscfd LNG from the BP Plc (BP LN) led Tangguh LNG project in Papua at US$9/mmbtu to US$10/mmbtu. BPMigas continues to urge PGAS to renegotiate their existing contracts to a market price of US$5/mmbtu to US$6/mmbtu to increase government revenues. BPMigas estimates the legacy contracts cost the government US$4bn per year in lost revenues. Comment: BPMigas’ has been calling for relegation of existing contracts since July/August this year. We have factored in the 140mmscfd LNG contract into our numbers coming onstream in 2013 at a cost of US$8/mmbtu with a distribution margin of US$2.5/mmbtu.

Pikko Group has mandated PT Sinarmas Sekuritas as a brokerage that helps conducting a tender offer for the remaining shares in PT Royal Oak Development Tbk (RODA).

In an official announcement yesterday, Pikko Land said Sinarmas Sekuritas will hold administrative tasks of the tender offer, including the settlement.

Pikko Land, founded in British Virgin Island, intends to hold the tender offer of 4.3 billion shares or 31.99% stake in Royal Oak, following a 68.01% take over.

Fundamentally:

CIMB menurunkan rating sektor mining dari OVERWEIGHT menjadi UNDERWEIGHT. Setelah koreksi 5 bulan berturut turut, nickel merupakan logam dengan kinerja terburuk di LME, dan sepertinya hal ini akan berlanjut hingga tahun depan apalagi karena global slowdown. Kami memangkas 2011-12 EPS by 5.3-53.9% pada perusahaan nickel dan memangkas ASP nickel dan target harga. Nickel akan oversupply sekitar 40k-130k ton pada 2011-12. Target harga kami sekarang adalah ANTM TP Rp1570, INCO TP Rp2950. Valuasi sektor ini menjadi 10.9 core forward PER atau 44% downside dari bottom 6.1x PER yang pernah dicapai pada 2008-09 lalu.

Bloomberg: Indonesia Cuts Guaranteed Rupiah Deposit Rate to 7% From 7.25%

Bloomberg: Rubber Futures in Tokyo Pare Earlier Gain of 1.4%

Bloomberg: Garuda Indonesia to Add 18 Planes Next Month, Kontan Reports

Bloomberg: Timah Plans to Boost Coal Output to 2 Million Tons, Kontan Says

Bloomberg: FX: SGD and MYR May Outperform USD Amid Uncertainty: Goldman

Bloomberg: Indonesia May Limit Foreign Investment in Local Mines

Bloomberg: Emerging Stocks Set for Best Six-Day Gain Since ‘09 on State Aid

Inilah Menu Saham Hari Ini

http://pasarmodal.inilah.com/read/detail/1784581/inilah-menu-saham-hari-ini

Rekomendasi Saham

IHSG Siap-siap Ikuti Penguatan Bursa Regional

http://finance.detik.com/read/2011/10/13/072608/1742888/6/ihsg-siap-siap-ikuti-penguatan-bursa-regional

Analis: IHSG akan bergerak mixed dan telah memasuki fase overbought

http://investasi.kontan.co.id/v2/read/1318470547/79858/Analis-IHSG-akan-bergerak-mixed-dan-telah-memasuki-fase-overbought

Target IHSG Berikutnya, 3.800-3.900

http://pasarmodal.inilah.com/read/detail/1784591/target-ihsg-berikutnya-3800-3900

Bursa Saham Terangkat Sentimen BI Rate

http://pasarmodal.inilah.com/read/detail/1784725/bursa-saham-terangkat-sentimen-bi-rate

Jangka Menegah, IHSG Terpangkas 'Double Digit'

http://pasarmodal.inilah.com/read/detail/1784608/jangka-menegah-ihsg-terpangkas-double-digit

Hasil Kinerja Sangat Baik, KRAS Menuju Rp 1500

http://pasarmodal.inilah.com/read/detail/1784724/hasil-kinerja-sangat-baik-kras-menuju-rp-1500

Sst.. MICE akan Buyback Saham

http://pasarmodal.inilah.com/read/detail/1784727/sst-mice-akan-buyback-saham

Bank Mandiri Klaim sudah Turunkan Bunga Kredit

http://pasarmodal.inilah.com/read/detail/1784728/bank-mandiri-klaim-sudah-turunkan-bunga-kredit

Saham BORN Berpotensi ke Rp1.450

http://pasarmodal.inilah.com/read/detail/1784731/saham-born-berpotensi-ke-rp1450

Pertumbuhan Kredit Bank Mandiri Melambat

http://pasarmodal.inilah.com/read/detail/1784735/pertumbuhan-kredit-bank-mandiri-melambat

Saham Eksportir Angkat Bursa Asia

http://pasarmodal.inilah.com/read/detail/1784740/saham-eksportir-angkat-bursa-asia

Prediksi suplai melonjak menekan pergerakan harga minyak

http://investasi.kontan.co.id/v2/read/1318466348/79851/Prediksi-suplai-melonjak-menekan-pergerakan-harga-minyak

Glencore meminta saham Bumi Plc

http://investasi.kontan.co.id/v2/read/1318465116/79848/Glencore-meminta-saham-Bumi-Plc

Harga CPO rontok, laba LSIP masih sip

http://investasi.kontan.co.id/v2/read/1318463457/79844/Harga-CPO-rontok-laba-LSIP-masih-sip

Investor melepas valuta Asia dan masuk ke dollar AS

http://investasi.kontan.co.id/v2/read/1318461498/79838/-Investor-melepas-valuta-Asia-dan-masuk-ke-dollar-AS

BATR kembali cari pinjaman US$ 500 juta

http://investasi.kontan.co.id/v2/read/1318432223/79830/BATR-kembali-cari-pinjaman-US-500-juta

ELTY akan lepas saham Bakrie Toll Road sampai Rp 2 triliun

http://investasi.kontan.co.id/v2/read/1318419607/79814/ELTY-akan-lepas-saham-Bakrie-Toll-Road-sampai-Rp-2-triliun

Harga kontrak emas kembali menanjak ke level tertinggi dua minggu

http://investasi.kontan.co.id/v2/read/1318431479/79828/Harga-kontrak-emas-kembali-menanjak-ke-level-tertinggi-dua-minggu

Wednesday, October 12, 2011

Derivatives: The $600 Trillion Time Bomb That's Set to Explode

Derivatives: The $600 Trillion Time Bomb That's Set to Explode

Do you want to know the real reason banks aren't lending and the PIIGS have control of the barnyard in Europe? It's because risk in the $600 trillion derivatives market isn't evening out. To the contrary, it's growing increasingly concentrated among a select few banks, especially here in the United States. In 2009, five banks held 80% of derivatives in America. Now, just four banks hold a staggering 95.9% of U.S. derivatives, according to a recent report from the Office of the Currency Comptroller. The four banks in question: JPMorgan Chase & Co. (NYSE: JPM), Citigroup Inc. (NYSE: C), Bank of America Corp. (NYSE: BAC) and Goldman Sachs Group Inc. (NYSE: GS).

READ MORE: http://moneymorning.com/2011/10/12/derivatives-the-600-trillion-time-bomb-thats-set-to-explode/

One of These Banks is Europe's Lehman Bros. – And We're Going to Profit From Its Collapse

Back in July, I warned you that Europe probably had its own Lehman Bros. - an unstable financial institution on the brink of a collapse. At the time, I didn't know exactly which institutions were most at risk. Now I have a pretty good idea and want to share that with you. One big firm, the Brussels-based Dexia SA, is already set to be dismantled. And based on an analysis of 50 European banks with a combined $129 billion (92 billion euros) tied up in Greek sovereign debt, I've identified two other suspect institutions: BNP Paribas SA, and Societe Generale SA (PINK: SCGLY).

READ MORE: http://moneymorning.com/2011/10/10/one-of-these-banks-is-europes-lehman-bros-and-were-going-to-profit-from-its-collapse/

7 Major Advance Warnings

As soon as we see the likelihood of major bankruptcies and defaults, we don’t wait around. We warn you immediately. We know you need time to get your money out of danger. And we also know that financial disasters don’t obey any particular clock. They can strike suddenly — especially in the stock and bond markets, where investors often start selling in anticipation of the troubles to come.

READ MORE: http://www.moneyandmarkets.com/7-major-advance-warnings-47579

Do you want to know the real reason banks aren't lending and the PIIGS have control of the barnyard in Europe? It's because risk in the $600 trillion derivatives market isn't evening out. To the contrary, it's growing increasingly concentrated among a select few banks, especially here in the United States. In 2009, five banks held 80% of derivatives in America. Now, just four banks hold a staggering 95.9% of U.S. derivatives, according to a recent report from the Office of the Currency Comptroller. The four banks in question: JPMorgan Chase & Co. (NYSE: JPM), Citigroup Inc. (NYSE: C), Bank of America Corp. (NYSE: BAC) and Goldman Sachs Group Inc. (NYSE: GS).

READ MORE: http://moneymorning.com/2011/10/12/derivatives-the-600-trillion-time-bomb-thats-set-to-explode/

One of These Banks is Europe's Lehman Bros. – And We're Going to Profit From Its Collapse

Back in July, I warned you that Europe probably had its own Lehman Bros. - an unstable financial institution on the brink of a collapse. At the time, I didn't know exactly which institutions were most at risk. Now I have a pretty good idea and want to share that with you. One big firm, the Brussels-based Dexia SA, is already set to be dismantled. And based on an analysis of 50 European banks with a combined $129 billion (92 billion euros) tied up in Greek sovereign debt, I've identified two other suspect institutions: BNP Paribas SA, and Societe Generale SA (PINK: SCGLY).

READ MORE: http://moneymorning.com/2011/10/10/one-of-these-banks-is-europes-lehman-bros-and-were-going-to-profit-from-its-collapse/

7 Major Advance Warnings

As soon as we see the likelihood of major bankruptcies and defaults, we don’t wait around. We warn you immediately. We know you need time to get your money out of danger. And we also know that financial disasters don’t obey any particular clock. They can strike suddenly — especially in the stock and bond markets, where investors often start selling in anticipation of the troubles to come.

READ MORE: http://www.moneyandmarkets.com/7-major-advance-warnings-47579

Laporan & Rumor Saham Indonesia 12-10 (Refresh)

Sesi I

Investor Asing Kembali Agresif, IHSG Menguat 61 Poin

http://finance.detik.com/read/2011/10/12/120441/1742209/6/investor-asing-kembali-agresif-ihsg-menguat-61-poin

Mantap! Sesi I, IHSG Menguat 1,7%. net foreign buy Rp298,7 miliar

http://pasarmodal.inilah.com/read/detail/1784395/mantap-sesi-i-ihsg-menguat-17

Akhir 2011, ASII Bersiap Anjlok ke Rp45.000

http://pasarmodal.inilah.com/read/detail/1784448/akhir-2011-asii-bersiap-anjlok-ke-rp45000

Strategi untuk ADRO, HRUM, BMRI & BBRI

http://pasarmodal.inilah.com/read/detail/1784424/strategi-untuk-adro-hrum-bmri-bbri

Bank Mandiri Bidik Pertumbuhan Kredit 22%

http://pasarmodal.inilah.com/read/detail/1784414/bank-mandiri-bidik-pertumbuhan-kredit-22

Barito Pacific Rencanakan Bagi Dividen

http://pasarmodal.inilah.com/read/detail/1784318/barito-pacific-rencanakan-bagi-dividen

Siap Tembus Rp560, Cermati Saham PTPP

http://pasarmodal.inilah.com/read/detail/1784315/siap-tembus-rp560-cermati-saham-ptpp

Sst.. Right Issue Bank Mandiri Naikkan BMPK

http://pasarmodal.inilah.com/read/detail/1784382/sst-right-issue-bank-mandiri-naikkan-bmpk

Masuk Tren Positif, IHSG Akhir Tahun Maksimal 3.800

http://finance.detik.com/read/2011/10/12/134129/1742340/6/masuk-tren-positif-ihsg-akhir-tahun-maksimal-3800

BBCA bakal garap bisnis online trading di awal 2012

http://investasi.kontan.co.id/v2/read/1318406832/79785/BBCA-bakal-garap-bisnis-online-trading-di-awal-2012

Akhir Oktober, GIAA tentukan pemenang pengadaan 18 pesawat

http://investasi.kontan.co.id/v2/read/1318404273/79779/Akhir-Oktober-GIAA-tentukan-pemenang-pengadaan-18-pesawat

Proyek rel kereta PTBA belum bisa mendapat pinjaman

http://investasi.kontan.co.id/v2/read/1318401726/79777/Proyek-rel-kereta-PTBA-belum-bisa-mendapat-pinjaman

Asing Net Sell Saham Rp 500 Miliar di Triwulan III-2011

http://finance.detik.com/read/2011/10/12/110152/1742131/6/asing-net-sell-saham-rp-500-miliar-di-triwulan-iii-2011

Laris Manis, Penjualan ORI008 Tembus Rp 5 Triliun

http://finance.detik.com/read/2011/10/12/071831/1741981/5/laris-manis-penjualan-ori008-tembus-rp-5-triliun

Bloomberg: Indonesia’s Coal Output May Grow 10%-14.5% a Year in 2011-2015

Bloomberg: Asian Stocks Pare Declines Amid Speculation Over China Buying

Bloomberg: Rupiah Declines for a Fourth Day After Bank Indonesia Cuts Rate

BORN masih memiliki Rp 498,08 miliar dari IPO

http://investasi.kontan.co.id/v2/read/1318382400/79726/BORN-masih-memiliki-Rp-49808-miliar-dari-IPO

Lunasi utang, Tuscany siapkan opsi rights issue Apexindo

http://investasi.kontan.co.id/v2/read/1318378800/79717/Lunasi-utang-Tuscany-siapkan-opsi-rights-issue-Apexindo

IMAS bangun 15 showroom di 2012

http://investasi.kontan.co.id/v2/read/1318377600/79715/IMAS-bangun-15-showroom-di-2012

INCO mulai mengoperasikan PLTA Karebbe

http://investasi.kontan.co.id/v2/read/1318325043/79690/INCO-mulai-mengoperasikan-PLTA-Karebbe

Saham produsen sawit melejit seiring rebound harga CPO

http://investasi.kontan.co.id/v2/read/1318390209/79750/Saham-produsen-sawit-melejit-seiring-rebound-harga-CPO

Harga karet reli, saham LSIP dan UNSP pun melejit

http://investasi.kontan.co.id/v2/read/1318390798/79753/Harga-karet-reli-saham-LSIP-dan-UNSP-pun-melejit

PT Harum Energy (HRUM) hingga kuartal III/2011 mencatatkan produksi 5,8 juta ton, naik 61,1% dibandingkan periode yang sama tahun lalu 3,6 juta ton. Dengan adanya peningkatan produsksi tersebut berdampak pada kenaikan penjualan sebesar 34,7%.Penjualan batu bara pada periode tersebut mencapai 6,2 juta ton dimana pada periode yang sama tahun lalu mencapai 4,6 juta

ton.

Agenda 12 Oktober Rups Indocitra Finance, DSSA RUPSLB, Akhir Tender Offer AIMS

Investor Asing Kembali Agresif, IHSG Menguat 61 Poin

http://finance.detik.com/read/2011/10/12/120441/1742209/6/investor-asing-kembali-agresif-ihsg-menguat-61-poin

Mantap! Sesi I, IHSG Menguat 1,7%. net foreign buy Rp298,7 miliar

http://pasarmodal.inilah.com/read/detail/1784395/mantap-sesi-i-ihsg-menguat-17

Akhir 2011, ASII Bersiap Anjlok ke Rp45.000

http://pasarmodal.inilah.com/read/detail/1784448/akhir-2011-asii-bersiap-anjlok-ke-rp45000

Strategi untuk ADRO, HRUM, BMRI & BBRI

http://pasarmodal.inilah.com/read/detail/1784424/strategi-untuk-adro-hrum-bmri-bbri

Bank Mandiri Bidik Pertumbuhan Kredit 22%

http://pasarmodal.inilah.com/read/detail/1784414/bank-mandiri-bidik-pertumbuhan-kredit-22

Barito Pacific Rencanakan Bagi Dividen

http://pasarmodal.inilah.com/read/detail/1784318/barito-pacific-rencanakan-bagi-dividen

Siap Tembus Rp560, Cermati Saham PTPP

http://pasarmodal.inilah.com/read/detail/1784315/siap-tembus-rp560-cermati-saham-ptpp

Sst.. Right Issue Bank Mandiri Naikkan BMPK

http://pasarmodal.inilah.com/read/detail/1784382/sst-right-issue-bank-mandiri-naikkan-bmpk

Masuk Tren Positif, IHSG Akhir Tahun Maksimal 3.800

http://finance.detik.com/read/2011/10/12/134129/1742340/6/masuk-tren-positif-ihsg-akhir-tahun-maksimal-3800

BBCA bakal garap bisnis online trading di awal 2012

http://investasi.kontan.co.id/v2/read/1318406832/79785/BBCA-bakal-garap-bisnis-online-trading-di-awal-2012

Akhir Oktober, GIAA tentukan pemenang pengadaan 18 pesawat

http://investasi.kontan.co.id/v2/read/1318404273/79779/Akhir-Oktober-GIAA-tentukan-pemenang-pengadaan-18-pesawat

Proyek rel kereta PTBA belum bisa mendapat pinjaman

http://investasi.kontan.co.id/v2/read/1318401726/79777/Proyek-rel-kereta-PTBA-belum-bisa-mendapat-pinjaman

Asing Net Sell Saham Rp 500 Miliar di Triwulan III-2011

http://finance.detik.com/read/2011/10/12/110152/1742131/6/asing-net-sell-saham-rp-500-miliar-di-triwulan-iii-2011

Laris Manis, Penjualan ORI008 Tembus Rp 5 Triliun

http://finance.detik.com/read/2011/10/12/071831/1741981/5/laris-manis-penjualan-ori008-tembus-rp-5-triliun

Bloomberg: Indonesia’s Coal Output May Grow 10%-14.5% a Year in 2011-2015

Bloomberg: Asian Stocks Pare Declines Amid Speculation Over China Buying

Bloomberg: Rupiah Declines for a Fourth Day After Bank Indonesia Cuts Rate

BORN masih memiliki Rp 498,08 miliar dari IPO

http://investasi.kontan.co.id/v2/read/1318382400/79726/BORN-masih-memiliki-Rp-49808-miliar-dari-IPO

Lunasi utang, Tuscany siapkan opsi rights issue Apexindo

http://investasi.kontan.co.id/v2/read/1318378800/79717/Lunasi-utang-Tuscany-siapkan-opsi-rights-issue-Apexindo

IMAS bangun 15 showroom di 2012

http://investasi.kontan.co.id/v2/read/1318377600/79715/IMAS-bangun-15-showroom-di-2012

INCO mulai mengoperasikan PLTA Karebbe

http://investasi.kontan.co.id/v2/read/1318325043/79690/INCO-mulai-mengoperasikan-PLTA-Karebbe

Saham produsen sawit melejit seiring rebound harga CPO

http://investasi.kontan.co.id/v2/read/1318390209/79750/Saham-produsen-sawit-melejit-seiring-rebound-harga-CPO

Harga karet reli, saham LSIP dan UNSP pun melejit

http://investasi.kontan.co.id/v2/read/1318390798/79753/Harga-karet-reli-saham-LSIP-dan-UNSP-pun-melejit

PT Harum Energy (HRUM) hingga kuartal III/2011 mencatatkan produksi 5,8 juta ton, naik 61,1% dibandingkan periode yang sama tahun lalu 3,6 juta ton. Dengan adanya peningkatan produsksi tersebut berdampak pada kenaikan penjualan sebesar 34,7%.Penjualan batu bara pada periode tersebut mencapai 6,2 juta ton dimana pada periode yang sama tahun lalu mencapai 4,6 juta

ton.

Agenda 12 Oktober Rups Indocitra Finance, DSSA RUPSLB, Akhir Tender Offer AIMS

Bloomberg: RATES: Indonesia May Keep Cutting Rates, Morgan Stanley Says

BLOOMBERG: *MARCH-DELIVERY RUBBER GAINS AS MUCH AS 0.4% IN TOKYO

Bloomberg: S&P Rates Indonesia’s Global Sukuk Trust Certificates ’Bb+’

Bloomberg; Rubber Futures Extend Losses in Tokyo, Dropping as Much as 2.5%

Bloomberg: Bank Indonesia ‘Confident’ 2011 Inflation Below 5%, Warjiyo Says. *BANK INDONESIA CONFIDENT CAN STABILIZE THE MARKET, WARJIYO SAYS. *BANK INDONESIA IS `CONFIDENT' 2011 INFLATION BELOW 5%: WARJIYO. *BANK INDONESIA NOT CONCERNED ON RUPIAH AFTER RATE CUT: WARJIYO

Bloomberg; Solusi Tunas Pratama May Buy Four Tower Companies, Bisnis Says

Bloomberg: Dian Swastatika Provides $100 Million Loan to Unit, Kontan Says

Inilah Daftar Saham Pilihan Rabu (12/10)

http://pasarmodal.inilah.com/read/detail/1784192/inilah-daftar-saham-pilihan-rabu-1210

Rekomendasi Saham

IHSG Kembali Diselimuti Kelesuan

http://finance.detik.com/read/2011/10/12/073154/1741984/6/ihsg-kembali-diselimuti-kelesuan

Ikuti Wall Street, Bursa Asia Memerah

http://pasarmodal.inilah.com/read/detail/1784326/ikuti-wall-street-bursa-asia-memerah

Sell on Strength pada Saham Penggerak IHSG!

http://pasarmodal.inilah.com/read/detail/1784198/sell-on-strength-pada-saham-penggerak-ihsg

Barito Pacific Rencanakan Bagi Dividen

http://pasarmodal.inilah.com/read/detail/1784318/barito-pacific-rencanakan-bagi-dividen

Siap Tembus Rp560, Cermati Saham PTPP

http://pasarmodal.inilah.com/read/detail/1784315/siap-tembus-rp560-cermati-saham-ptpp

Pemangkasan BI Rate Masih Perlemah Rupiah

http://pasarmodal.inilah.com/read/detail/1784171/pemangkasan-bi-rate-masih-perlemah-rupiah

Sst.. Suku Bunga Kredit BCA Berpotensi Turun

http://pasarmodal.inilah.com/read/detail/1784154/sst-suku-bunga-kredit-bca-berpotensi-turun

IHSG Naik Berikan Sentimen Positif Saham Perdana

http://pasarmodal.inilah.com/read/detail/1784141/ihsg-naik-berikan-sentimen-positif-saham-perdana

BI Rate Turun, Rupiah Murung

http://pasarmodal.inilah.com/read/detail/1784097/bi-rate-turun-rupiah-murung

Saham KIJA Terbanyak Dijual Asing Selasa (11/10)

http://pasarmodal.inilah.com/read/detail/1784081/saham-kija-terbanyak-dijual-asing-selasa-1110

Jika Tembus 3.300, IHSG Kritis ke 2.550

http://pasarmodal.inilah.com/read/detail/1784206/jika-tembus-3300-ihsg-kritis-ke-2550

BLOOMBERG: *MARCH-DELIVERY RUBBER GAINS AS MUCH AS 0.4% IN TOKYO

Bloomberg: S&P Rates Indonesia’s Global Sukuk Trust Certificates ’Bb+’

Bloomberg; Rubber Futures Extend Losses in Tokyo, Dropping as Much as 2.5%

Bloomberg: Bank Indonesia ‘Confident’ 2011 Inflation Below 5%, Warjiyo Says. *BANK INDONESIA CONFIDENT CAN STABILIZE THE MARKET, WARJIYO SAYS. *BANK INDONESIA IS `CONFIDENT' 2011 INFLATION BELOW 5%: WARJIYO. *BANK INDONESIA NOT CONCERNED ON RUPIAH AFTER RATE CUT: WARJIYO

Bloomberg; Solusi Tunas Pratama May Buy Four Tower Companies, Bisnis Says